Bridge assets to OP Mainnet

Start by bridging ETH or stables. Keep a gas buffer for OP Mainnet transactions.

This is a practical, safety-first guide to the Optimism Ecosystem in 2026: what kinds of apps exist on OP Mainnet, how users typically move from bridge → swap → DeFi, which categories matter most (DEX, lending, liquid staking, bridges, perps, NFTs, yield, governance), and how to choose dApps safely without falling for phishing, fake tokens, or bad approvals.

Start by bridging ETH or stables. Keep a gas buffer for OP Mainnet transactions.

Use a DEX to get the tokens you actually use (ETH/WETH, stables, ecosystem tokens).

Pick reputable apps and verify contracts. Don’t grant unlimited approvals on a high-value wallet.

After you’re done, revoke allowances you don’t need and keep records of addresses and tx hashes.

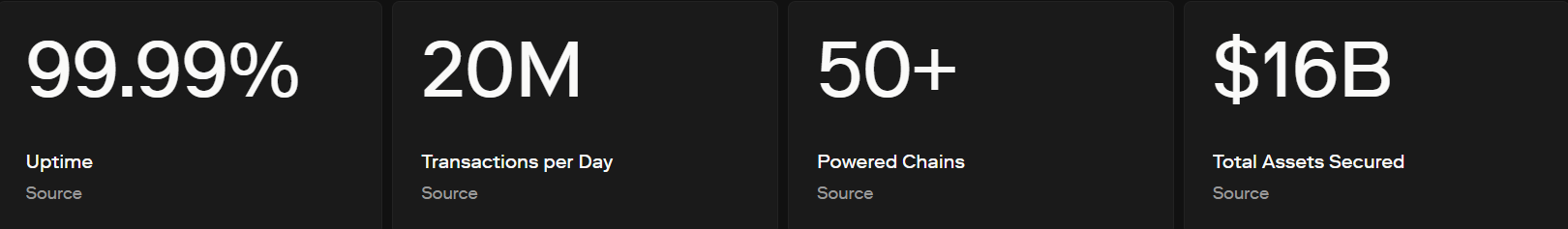

The Optimism ecosystem is the collection of applications and infrastructure running on OP Mainnet. Users come to Optimism for lower fees, faster UX, and a deep set of DeFi and consumer apps. The operational goal is simple: bridge once, do multiple actions on OP, and keep security hygiene tight.

Everyday DeFi: swaps, lending, yield strategies, on-chain tools, and apps that benefit from low fees.

App risk and user error. Most losses come from phishing, fake tokens, and unlimited approvals.

The ecosystem is easiest to understand by category. Most user journeys start with bridging and swapping, then branch into lending, yield, perps, NFTs, or governance.

| Category | What it does | Why users use it | Safety note |

|---|---|---|---|

| DEX / Swap | Trade tokens (ETH/WETH, stables, OP tokens) | Routing into DeFi positions | Verify token contracts; avoid spoofed tokens |

| Lending / Borrowing | Supply collateral, borrow assets | Leverage, liquidity, yield | Liquidation risk; oracle/market risk |

| Liquid Staking | Staked exposure via liquid tokens | Yield + DeFi composability | Contract + peg risk; understand exit routes |

| Bridges | Move assets across chains | Funding OP, withdrawing to L1 | Fast bridges add third-party risk |

| Perps / Derivatives | Leverage trading | Speculation, hedging | High liquidation risk; manage position sizing |

| NFTs / Gaming | Collectibles and consumer apps | Low-fee minting and trading | Fake mints; malicious approvals |

| Governance / Grants | Vote and participate in ecosystem decisions | Influence and funding | Signature hygiene; verify domains |

Most users rely on a small set of core assets for routing and gas. Always verify token contracts on the OP explorer—tickers can be spoofed.

| Token | Why it’s common | Operational note |

|---|---|---|

| ETH | Gas + base asset | Keep a gas buffer |

| WETH | DEX routing + DeFi collateral | Wrap only what you need |

| USDC / USDT / DAI | Stable trading, lending, risk-off | Choose deepest liquidity |

| OP | Governance/ecosystem activity | Verify official contract |

| WBTC | BTC exposure in DeFi | Verify contract + route |

Most OP Mainnet actions are low-cost compared to Ethereum mainnet, but you still pay for: bridging (L1 gas), swaps, approvals, and exit steps.

| Fee line | Where it appears | How to reduce it |

|---|---|---|

| Bridge-in (L1 gas) | Ethereum deposit tx | Bridge when L1 is quiet; deposit once, do more on OP |

| Approvals | Token approvals for dApps | Use limited approvals; avoid repeated approvals |

| Swaps & DeFi actions | DEX trades, lending, staking | Batch actions; avoid unnecessary hops |

| Exit (L2→L1) | Finalize/withdraw steps | Plan exits; don’t emergency-withdraw |

Keep this block clean and authoritative. Replace the ecosystem directory link with the official page you prefer.

The Optimism ecosystem is the set of applications, tools, and infrastructure running on OP Mainnet—covering DeFi, NFTs, bridges, governance, and more.

You typically need ETH for gas on OP Mainnet and a starting asset (ETH or stables). Most users bridge in once, swap what they need, then use dApps.

Use official directories, verify domains, confirm contracts on the OP explorer, test with small amounts, and avoid unlimited approvals on a high-value wallet.

ETH is the gas token on OP Mainnet. Without ETH, you can’t pay transaction fees for swaps, approvals, or transfers.

Phishing and malicious approvals. Always verify URLs and contracts, and revoke allowances you don’t need.

Switch to OP Mainnet, verify balance on the OP explorer, then import the token by contract address if needed.

Often, bridging ETH and swapping on OP can be simpler and liquid, but it depends on liquidity and fees. Always verify routes and keep gas buffers.